Basic Terminologies to Get Started with Stock Market Trading

Stock market basics for beginners, how to start trading stocks, stock trading terms explained, beginner stock market glossary, simple stock trading terms, stock market terms for beginners, basic stock trading terminology, understanding stock market terms.

Importance of understanding stock market terms!

Starting your investment journey without understanding simple stock trading terms is like getting into the driver's seat of the car without knowing what the brake and accelerator do.

Having good knowledge of basic trading terms is the first step in answering the most frequently asked question by beginners, which is how to start trading stocks.

Below are the stock trading terms explained for the beginners:

Types of stock orders

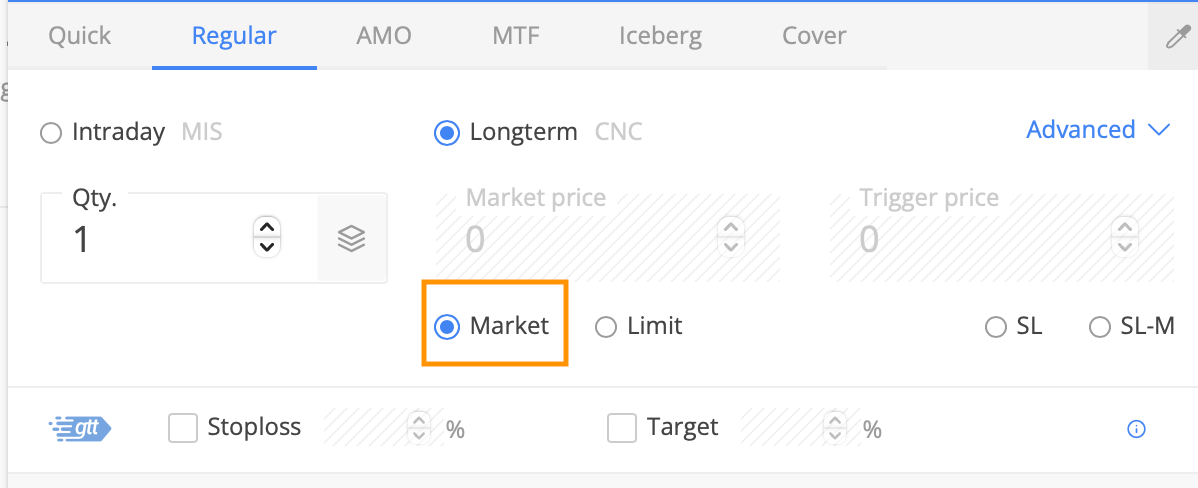

- Market order

This is one of the simplest orders one can place, where you can buy or sell stock instantly at the current price available.

When to use: When you just want to execute the order instantly at the current price and you are okay with the minor fluctuation in the stock’s price while executing it.

When not to use: When the market is very volatile and it may change rapidly at the time of execution of your order, and you may not get the price that you expected.

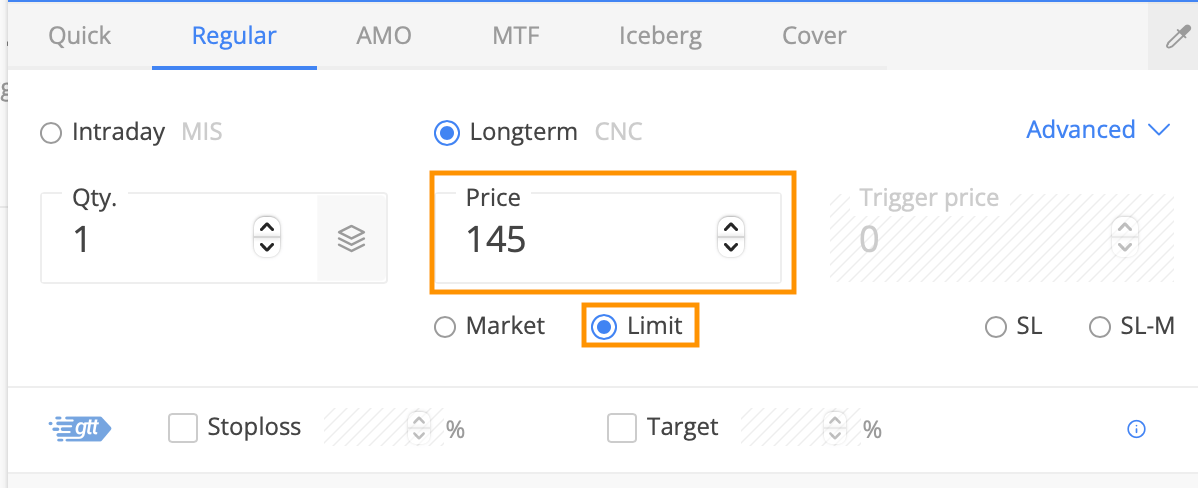

- Limit order

A limit order allows you to buy or sell a stock at a predefined price, where the order is executed only when that particular price has been reached.

When to use: When you have already analyzed the stock and you know when to buy or sell.

When not to use: When you are not confirmed where the stock may go and you put the limit order randomly, this creates a risk of non-execution of orders.

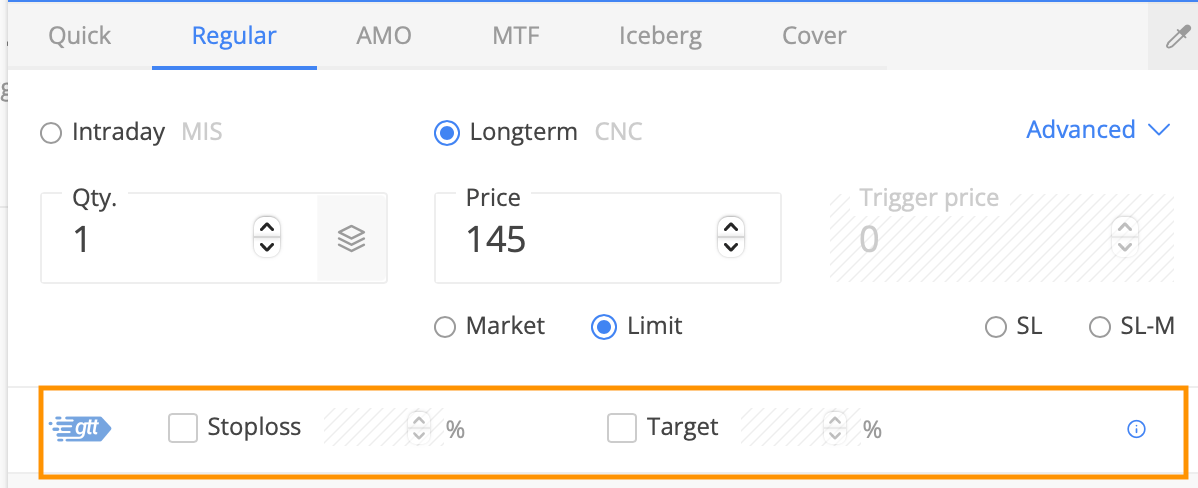

- GTT (Good till triggered)

This is similar to “limit orders,” but the only difference is it will remain active till the order is executed.

When to use: When applying for “stop-loss” or “target”

When not to use: If you are not confirmed about the volatility of the stock, this will create the risk of executing an order at the wrong position or non-execution of the order.

- Stop Loss

A type of GTT (Good till triggered) where traders use this to limit their losses.

This order is placed with the intention of saving the investor’s fund if the strategy does not work as expected.

This order is placed below the entry point, and if the stock starts declining and reaches the stop-loss, the sell order will automatically get executed and save the investor from further losses.

When to use: Ideally, it should be used 90% of the time, as in stock investing, risk management is mandatory.

When not to use: When you want to avoid false triggering of stop-loss either because there are some events going on or the stock is too volatile.

Click here to check it by yourself

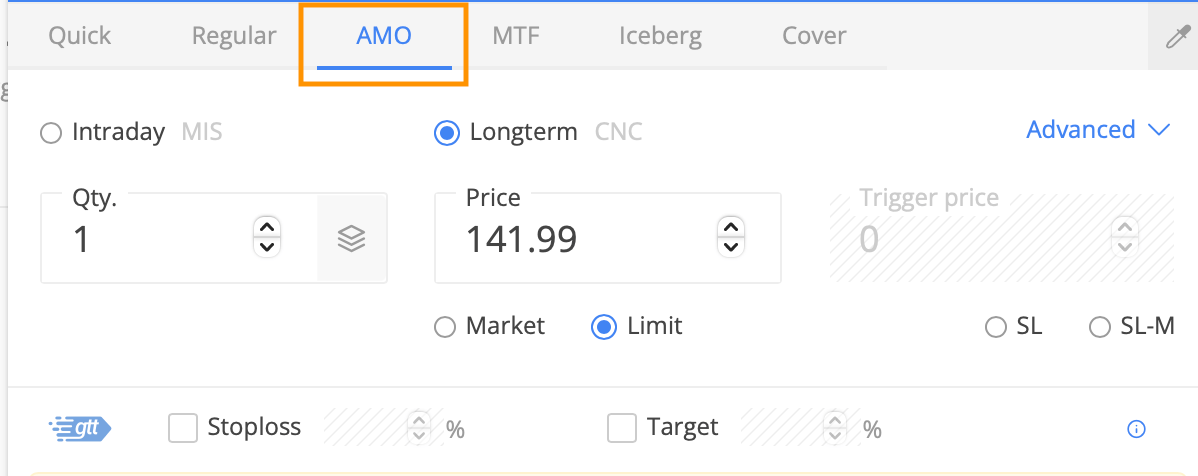

- After Market Order (AMO)

The stock market has a certain time frame where any trading activity will take place during this time frame only.

Like in India, the stock market is open from 9:15 am to 3:30 pm, and on Saturday, Sunday, and other public holidays, the market remains closed, and no trading activity takes place during this time.

An AMO, or after-market order, is a type of order that you place when the market is closed for whatever reason.

Simple stock trading terms:

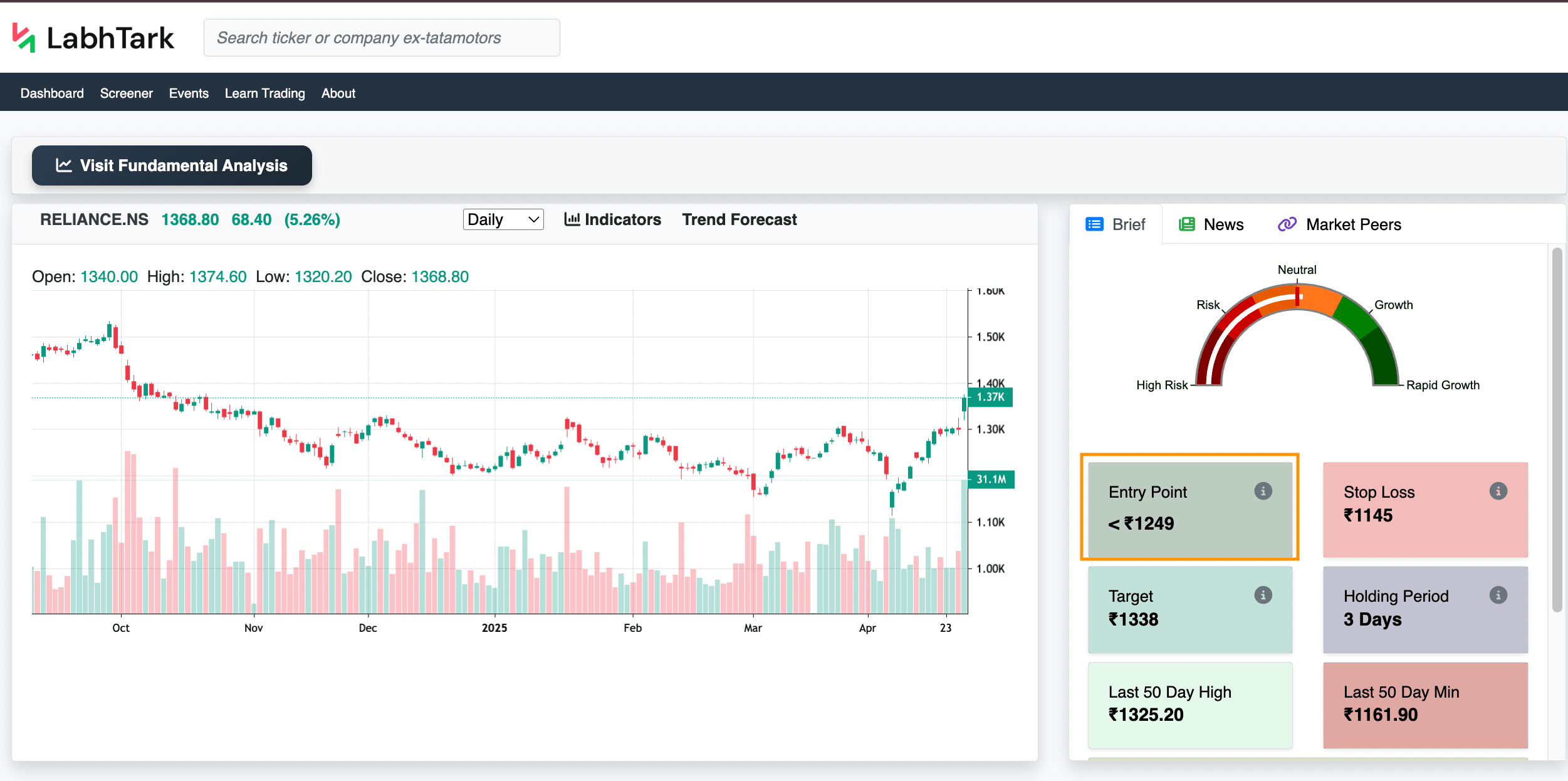

- Target Price

Basically this is the price at which investors decide to sell the stock and to take profit.

For example, if someone bought a stock at 100 rupees and is planning to sell at 150 rupees, then 150 rupees is the target for this trade.

Click here to check it by yourself

- Entry Price

This is the price at which investors decide to buy a stock or take a position (can be long or short).

Investors predetermine the entry price or entry point for any trade to take the maximum advantage according to their trading strategy.

For example, if a stock’s current price is 105 rupees but, according to the trader’s plan, the entry point is at 100 rupees, then the investor will wait till the price is at the desired point and then take any position.

Click here to check it by yourself

- Risk-Reward Ratio

It is a simple ratio that measures how much profit you are going to make with respect to that amount you have put at risk.

For example, if you bought a stock at 100 rupees, put a stop-loss at 80 rupees, and target 150 rupees, then you are risking your 20 rupees with an expected return of 50 rupees, and your risk-reward ratio is 2:5.

- Margin Trading

It’s a type of trading where investors borrow money from their broker to buy stocks.

This magnifies the profits that the trader is going to make, but at the same time it will magnify the loss as well.

- Intraday trading vs. delivery

Intraday trading is when a trader buys and then sells a stock on the same day, whereas delivery is when a trader buys a stock for more than a day.

The above stock market trading terminologies will help you to get started with your trading journey, but this is the first step towards your success in the stock market.

To learn more about how technical analysis works and how to perform technical analysis for any stock, visit our detailed tutorial for the same; below are the links:

Check our screener for filtering stocks according to technical and fundamental analysis.