Understanding Risk and Return

Risk-Reward Ratio

This ratio calculates the estimated returns over the amount of risk for the particular trade.

Example: For example you bought a stock worth of $100 and planned a target price of $150 and put a stop loss at $90, which means total risk you are taking is $10 for $50 of gain which will give 1:5 of Risk-Reward ratio.

| Investment Scenario | Risk Level | Reward Potential | Risk-Reward Ratio |

|---|---|---|---|

| High Risk Investments (like Cryptocurrencies or Penny Stocks) | Extremely High | Extremely High | 1:4 or higher |

| Moderate Risk Investment (like mutual funds or growth stocks) | Moderate | Moderate or higher | Between 1:2 and 1:3 |

| Low-Risk Investment (Like Bonds or Fixed Deposit) | Low | Low or Moderate | Between 1:1 and 1:2 |

| Very low Risk Investment ( Like Savings accounts or Treasury Bills) | Very Low | Very Low | Lower than 1:1 |

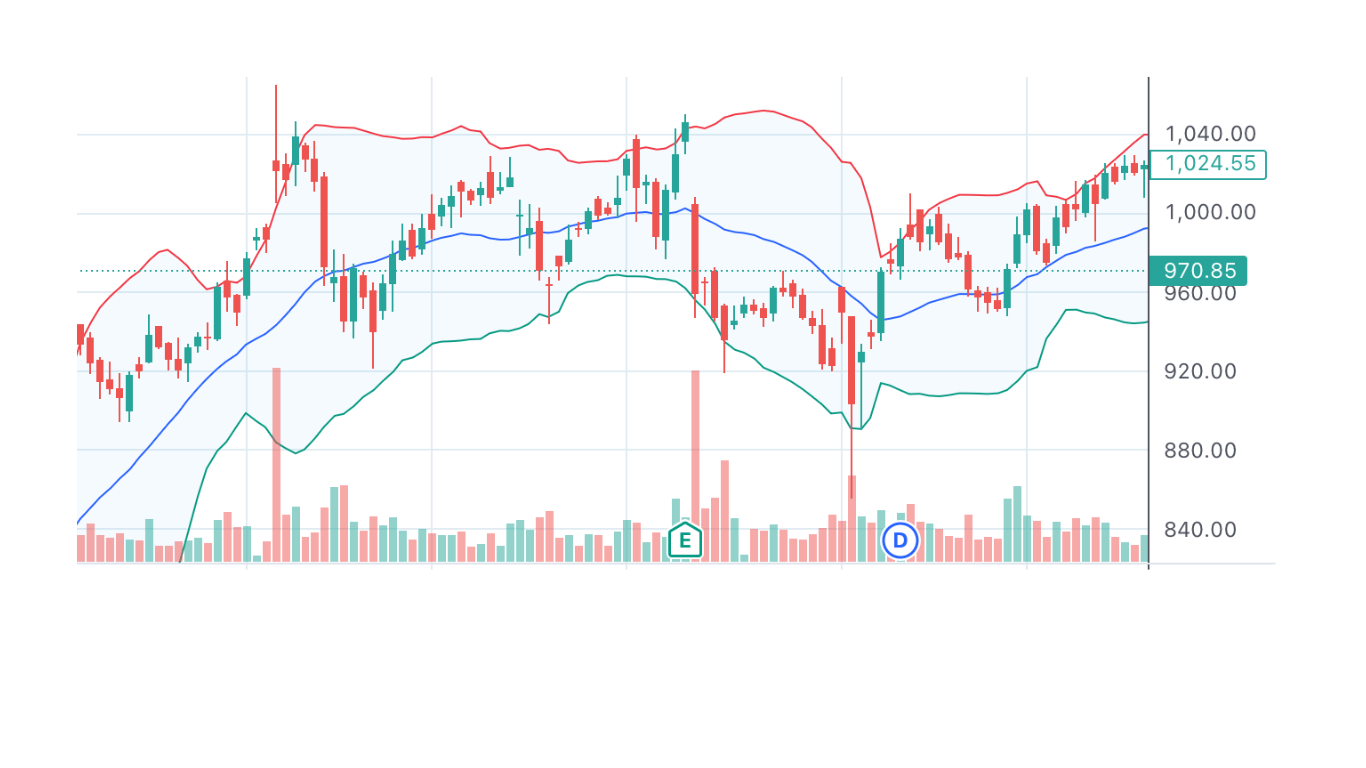

Volatility and Its Impact on Stocks

Volatility is nothing but change in price of a stock over a particular interval of time.

Example: If the price of stock changes around $10 daily then volatility of stock is around $10 and let’s say the same stock’s price changes around 20$ weekly then it’s weekly volatility is 20$ and if you are planning to take $50 profit per stock over a week will be completely impractical.

Diversification and Portfolio Management

DiversificationThis is a risk management technique where instead of putting all the funds in one stocks, but buying less quantity of multiple stocks specifically from opposing sectors so that if one stock is not performing well others can cover for it.