Types of Market

What are Primary and Secondary Markets?

- Primary Market: This is where the company offers their stocks for the first time in the stock market which is also called as listing of company in stock market and in easy terms primary market is where company sells its shares to common public for the first time to common public.

- Secondary Market: When the stocks are introduced in primary market and the people who bought the shares tends to trade it further when the valuation of company changes and sell the stocks for a changed price to make profits and this goes on where investors buy and sell the stocks to one another and place where it take place is called Secondary Market.

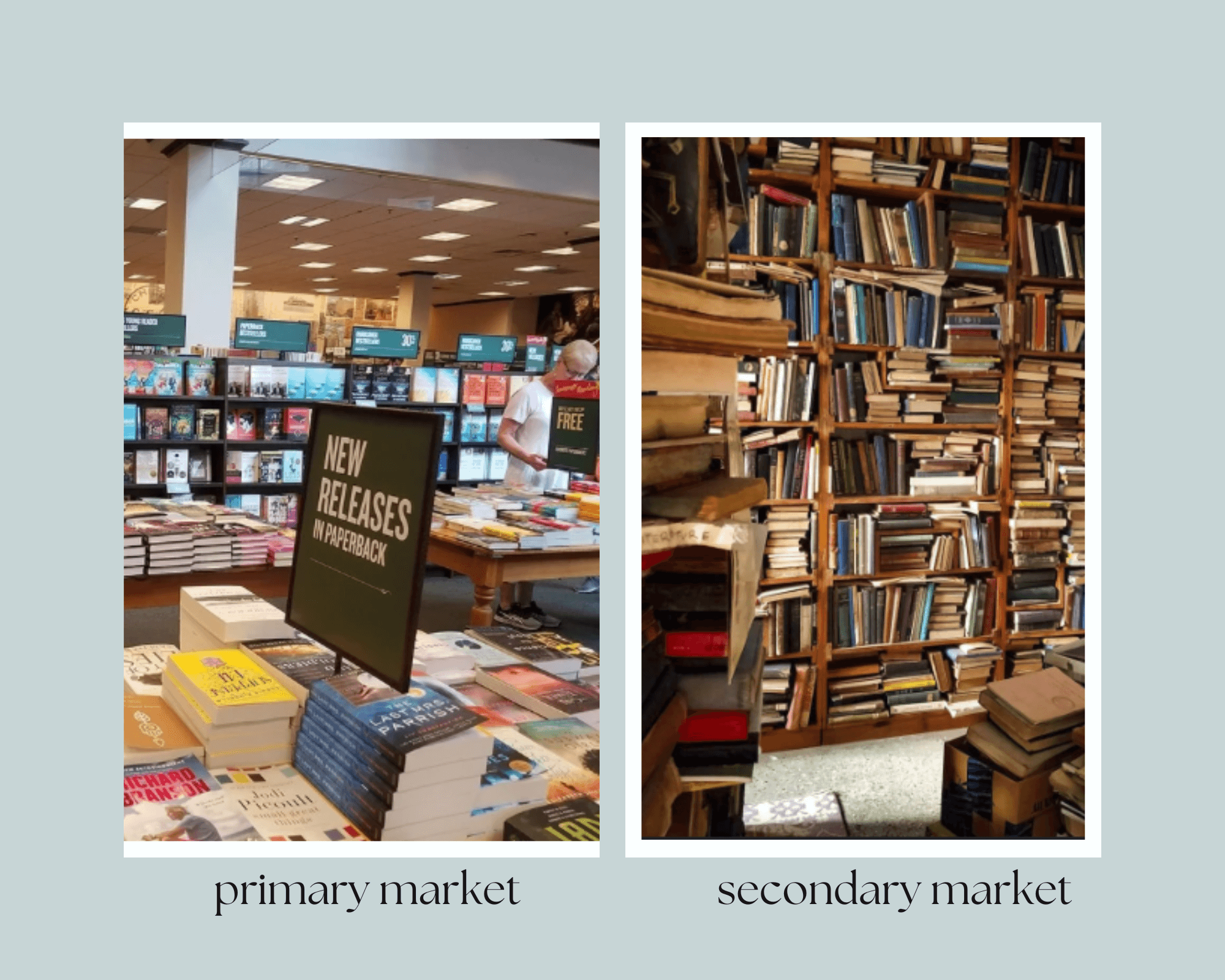

Example: Just take a example of a book shop which sells brand new books which comes directly from the publishing houses these are like Primary Market, now think of secondary market as pre-used books where books come from people who previously owned it and sell it to another people.

What are IPOs and FPOs and what are difference between both ?

- Initial Public Offering (IPO):Initial Public Offering is the process of offering the shares to the investors for the first time in the Primary Market.

- Follow-on Public Offering (FPO):Follow-on Public offering is the process the already listed company re-issues extra shares in the stock market.

| Aspect | IPO (Initial Public Offering) | FPO (Follow-on Public Offering) |

|---|---|---|

| Definition | When non-listed company issues stock for the first time | When already listed company re-issues shares in the market |

| Objective | To raise funds to expand the company’s operations. | To raise additional fund required to multiple reasons for company’s growth strategy. |

| Company Status | Non-listed Private companies | Already listed company in stock market. |

| Risk Level | Higher, as no past performance data available publicly. | Relatively lower as past performance are publicly available. |

| Investor Confidence | It depends on market sentiment and market growth opportunity for the particulate sector. | Relatively higher as company has already build some reputation in the past. Pricing |

| Pricing | Generally determined by book building or fixed price method. | Determined by current market valuation of the company. |

| Regulatory Requirements | A more strict and robust compliance process. | Comparatively fewer compliances process. |