Psychological Levels

Psychological Levels in Stock Trading: Round Numbers as Key Support and Resistance

In the stock Market, prices don't necessarily in every case move in perfect patterns or follow technical indicators precisely. Once in a while, the manner in which individuals contemplate stock prices assumes an immense part in how prices act. One of the least difficult yet most remarkable mental variables in trading is the round number.

1. What Are Psychological Levels?

Psychological Levels allude to sticker prices that traders and financial backers centre around just on the grounds that they are not difficult to recall or appear important. These levels are for the most part round numbers like ₹100, ₹500, or ₹1,000. Individuals are normally attracted to these numbers while going with trading choices.

Example: In the event that a stock is trading close ₹500, numerous traders might feel it's a significant price level. They could say, "I'll buy assuming it drops to ₹500," or “Sell in the event that it comes to ₹1,000.”

Why Do Round Numbers Matter?

Round numbers frequently go about as Support or resistance in view of the manner in which traders think:

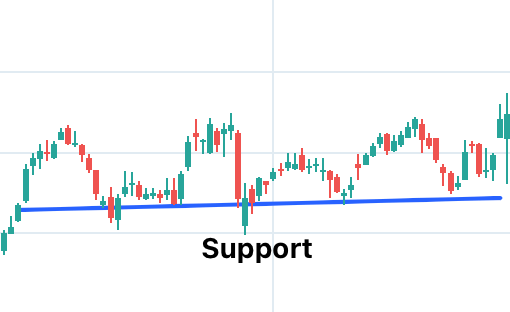

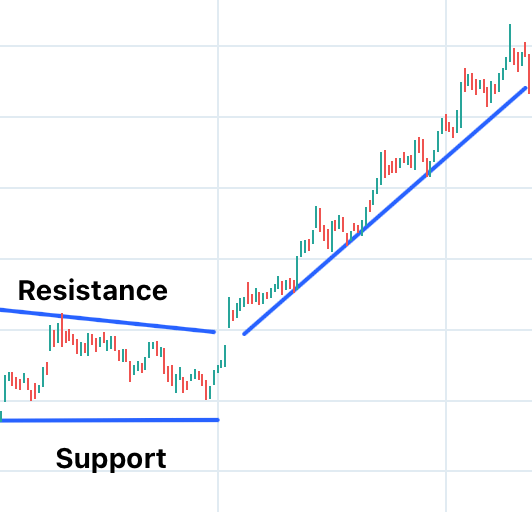

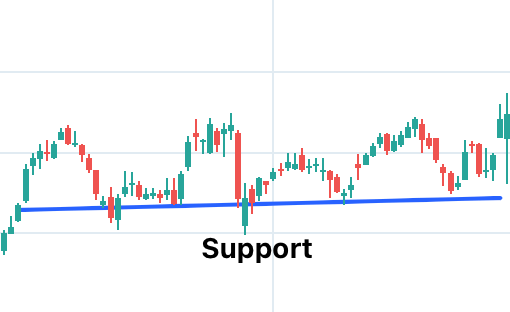

- Support: A round number can go about as a "story" where the price quits falling and fires returning up. Traders consider it to be a reasonable setup to buy when the value drops to a pleasant, significantly number.

- Resistance: A round number can go about as a "roof" where the value battles to transcend. traders could think the stock is excessively pricey at that number, and they begin selling.

2. How Round Numbers Act as Key Support and Resistance

Support at Round Numbers: When a stock's price moves toward a round number, as ₹500 or ₹1,000, buyers will more often than not step in light of the fact that they accept the stock is at a sensible price. This encourages interest, which keeps the price from falling further, framing support.

Example of Support: Envision a stock that has been trading somewhere in the range of ₹450 and ₹550 for half a month. Each time the price drops close ₹500, buyers rush in and push the price back up. This makes a mental support level at ₹500.

Resistance at Round Numbers

Essentially, round numbers can go about as resistance when traders accept the stock is overrated at a specific level. For instance, if a stock strategies ₹1,000, numerous brokers might choose to sell since they feel it's a decent price to exit. This makes supply, keeping the price from rising further.

Example of Resistance: Suppose a stock is climbing consistently and hits ₹1,000. traders accept this is a "Psychological critical" number, so they start selling , making the stock battle to move higher and makes resistance at ₹1,000.

3. Real-World Examples of Round Numbers as Support and Resistance

To make this significantly more clear, how about we take a gander at how Psychological Levels work out in reality.

Example 1: ₹100 Support Level

Envision an organisation’s stock that has been trading somewhere in the range of ₹90 and ₹110. Each time the price drops near ₹100, buyers begin purchasing the stock, believing it's an extraordinary arrangement pricing that much. This makes a mental support level at ₹100, in light of the fact that individuals feel sure the stock won't fall much underneath this number.

Example 2: ₹1,000 Resistance Level

Presently, consider a stock that has been rising consistently and approaches ₹1,000. At the point when it gets close ₹1,000, brokers and financial backers begin selling the stock since they think ₹1,000 is a decent price to exit. This makes a mental resistance level at ₹1,000, as the stock battles to get through this price.

Example 3: Breaking Through Psychological Levels

Once in a while, when a stock gets through a round number, it can set off significantly greater price moves. This happens on the grounds that numerous traders have set orders to trade at these levels. At the point when the price gets through, it causes a surge of orders, pushing the price rapidly in one direction.

4. How to Use Round Numbers in Your Trading

Realising that round numbers go about as mental resistances, you can involve this data in your trading procedure.

- Buy Near Support: On the off chance that you see a stock reliably finding support almost a round number, it very well may be a great opportunity to buy, as the stock is probably going to return quickly up. Sell Close to resistance: If a stock battles to get through a round number, it very well may be a great chance to sell, as the price might begin tumbling starting there.

Example of a Trading Strategy: : Envision you're watching a stock that has been bobbing between ₹200 (support) and ₹250 (resistance). You could buy close ₹200, anticipating that the price should rise, and afterward sell close ₹250, anticipating that the price should drop. This is a basic method for involving Psychological Levels in your trading.

Conclusion: Mastering Psychological Levels

Psychological Levels, particularly round numbers, assume a significant part in the stock market. These levels frequently go about as support or resistance in light of traders' opinion on price. By understanding these levels and seeing how prices respond to them, you can settle on more intelligent trading choices.

- Support: Round numbers can go about as a pad, keeping prices from falling further.

- Resistance: Round numbers can go about as a roof, keeping prices from ascending higher.

- Breakouts: When prices get through Psychological Levels, they frequently take large actions.

With training, you'll have the option to recognise these levels on charts and use them to design your exchanges